GM

- Activist investment fund Engine No. 1 said Monday it has a stake in General Motors.

- The hedge fund's founder Chris James says GM is embracing the future by focusing on electric vehicles.

- The hedge fund previously won a proxy fight against oil giant Exxon.

- See more stories on Insider's business page.

Engine No. 1, an activist hedge fund that won seats on oil giant Exxon's board in a historic proxy fight, has taken a stake in General Motors as the largest automaker in the US furthers its focus on producing zero-emissions vehicles.

"General Motors is an industry is going through a transition. Of course, Exxon [is] going through the energy transition. That's really where the analogy stops. GM has taken with the support of a really strong management team, a great board, has decided that they're going to embrace the future," Chris James, founder of Engine No. 1, said in an interview on CNBC on Monday. He did not disclose the size of its stake in GM.

Shares of General Motors shares rose as much as 3.1% to $54.80 then pared the rise to 2.5%.

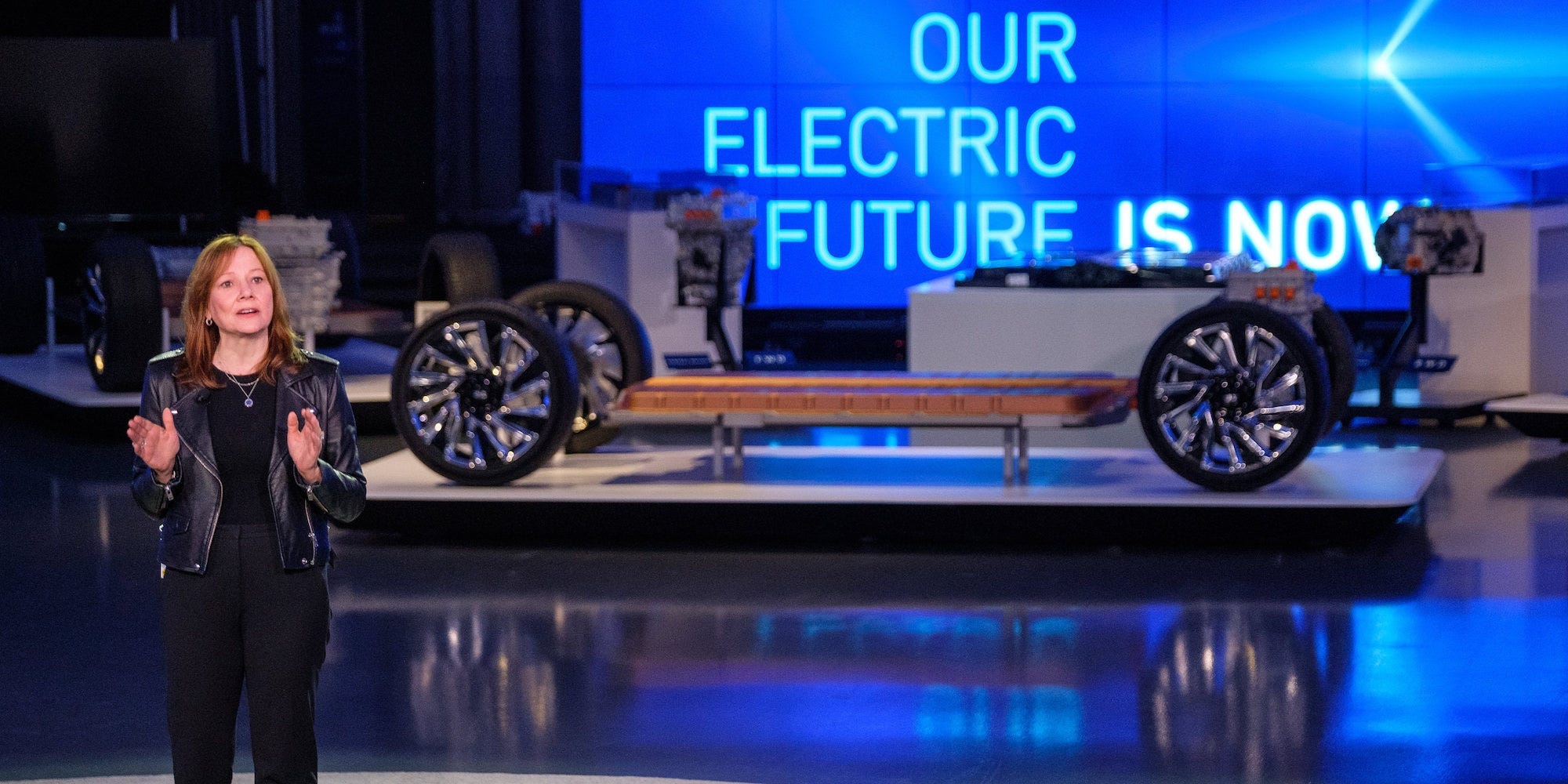

General Motors earlier this year unveiled Ultium, a new electric-battery design, and said it would roll out in nearly two dozen electric vehicle models by 2023.

"By investing in a new platform, by going all in [into battery EVs], we think that they can be successful in this transition," James told CNBC. "In most cases, incumbents tend to protect their legacy business first and in doing so end up being very slow in the adoption of new technologies."

The stake disclosure arrives ahead of General Motors is set to meet with investors on Wednesday. The company is planning to position itself as a technology platform company focused on software as well as on making electric vehicles, sources told Reuters.

The hedge fund won three climate-focused seats on Exxon's board earlier this year. The contentious proxy battle centered around green energy initiatives, diversification of Exxon's fossil fuel business, and executive pay.